Friday, April 22, 2022

Friday, April 8, 2022

Wednesday, March 23, 2022

Friday, February 11, 2022

Friday, February 4, 2022

Tuesday, February 1, 2022

Friday, January 21, 2022

Monday, January 17, 2022

Tuesday, January 4, 2022

Thursday, December 30, 2021

Monday, December 27, 2021

Monday, November 15, 2021

Market Rigging - Noooo

Wall Street Is Not Only Rigging Markets, but It’s Also Rigging the Outcome of

its Private Trialshttps://wallstreetonparade.com

The Fed's Board of Governors Is Blocking the Release of Former Dallas Fed President's Trading Records - Say What?

The Fed's Board of Governors Is Blocking the Release of Former Dallas Fed

President Robert Kaplan’s Trading Recordshttps://wallstreetonparade.com

Jamie and Jerome's private meeting

Jerome Powell and Jamie Dimon Met Privately on September 30. Weird Stuff

Followed.https://wallstreetonparade.com

Thursday, November 4, 2021

Americans Don't Trust the Fed

Prior to the Fed’s Trading Scandal, an Axios/Ipsos Poll Found 53 Percent of

Americans Didn’t Trust the Fed

https://wallstreetonparade.com

Biden's Nominee Omarova

Biden’s Nominee Omarova Called the Banks She Would Supervise the

“Quintessential A**hole Industry” in a 2019 Feature Documentary

https://wallstreetonparade.com

The Fed, Inspector General and JP Morgan

The Inspector General’s Report on JPMorgan’s London Whale Is a Guide to

What to Expect from Its Probe of the Fed’s Trading Scandal

https://wallstreetonparade.com

Friday, October 22, 2021

Wall Street Journal, New York Times Censor Major News Story on the Fed and Mega Banks

The Wall Street Journal and New York Times Censor Yet Another Major News Story

on the Fed and the Mega Banks It Supervises

https://wallstreetonparade.com

Fed Bank President's Financial's Failing the Smell Test

Another Fed Bank President’s Financial Disclosures Fail the Smell Test

https://wallstreetonparade.comThe SEC and Dark Pools

The SEC Is Taking a Hard Look at Dark Markets, Except for the Darkest of All

– Dark Pools

https://wallstreetonparade.com

Emergency Repo Loans

Quietly, the Fed Releases the Names of Banks that Got Billions in Emergency

Repo Loans in 2019

https://wallstreetonparade.com

Dallas Fed and Robert Kaplan

The Dallas Fed Board Is Now Complicit in the Robert Kaplan Saga

https://wallstreetonparade.com

1929

The U.S. Banking System Is More Dangerous Today than in 1929, Thanks to the

Fed’s Reg U and Swaps – Two Well-Kept Secrets from the Senate Banking

Committee

https://wallstreetonparade.com

Federal Reserve Trading Scandal

New Documents Show the Fed’s Trading Scandal Includes Two of the Wall Street

Banks It Supervises: Goldman Sachs and Citigroup

https://wallstreetonparade.com

Friday, October 1, 2021

Goldman Sachs and the Federal Reserve Hedge Fund

Goldman Sachs Refuses to Say If It Was Placing Trades for Dallas Fed President

Kaplan as Materially False Statement Released by Board on Kaplan'sRelationship with Goldman Sachs

https://wallstreetonparade.com

Is a Market Crash Impossible?

Authored by Charles Hugh Smith via OfTwoMinds blog,

The banquet of consequences is being served, and risk-off crashes are, like revenge, best served cold.

The ideal setup for a crash is a consensus that a crash is impossible--in other words, just like the present: sure, there are carefully measured murmurings about a "correction" but nobody with anything to lose in the way of public credibility is calling for an honest-to-goodness crash, a real crash, not a wimpy, limp-wristed dip that will immediately be bought.

What I'm calling for is a rip your face off, weeping bitter tears over the grave of the speculative wealth that you thought was forever crash. All those buying the dip because the Fed will never let the market go down will be crushed like scurrying cockroaches and all those trying to rotate into the next hot sector or asset class will also be crushed like scurrying cockroaches because when the Everything Bubble pops, well, everything pops. There is no shelter in a risk-off cascade.

The crash is coming as a result of multiple mutually reinforcing dynamics, the first being that no "serious person" believes a crash is possible, much less imminent. In no particular order, here are a raft of other causally consequential triggers of a cascading market crash:

1. As I noted in my call for the top, Is Anyone Willing to Call the Top of the Everything Bubble? (September 6, 2021), there is no history to support the widespread confidence that the extremes of over-valuation, leverage, euphoria and speculation last forever, or even much longer than the lifespan of a cockroach. We're well past that benchmark into unprecedented insanity. So what happens next: squish.

Just for the record, the Dow topped out on August 13, the S&P 500 topped out on September 2 and the Nasdaq topped out the day after my call, September 7. (Close enough for gummit work...)

2. The credibility of the Federal Reserve is in the dumpster, which just caught fire.

As I explained in The Fed Is Fatally Corrupt-- And So Is the Rest of America's Status Quo (September 10, 2021), the Fed is corrupt on multiple levels--thoroughly, completely corrupt, and so are all its minions, proxies, apparatchiks, toadies, apologists and lackeys.

This is finally leaking through the Fed corruption containment vessel as even the lackeys in the billionaire-owned corporate media are now fearful of losing whatever tattered shreds of credibility they still possess by refusing to acknowledge Fed corruption, over-reach and hubris. And so at long last, the Fed no longer walks on water. The Fed's fraudulent travesty of a mockery of a sham scam has finally breached the three-foot thick containment walls and the putrid stench of Fed corruption can no longer be bottled up.

Like any good kleptocratic Politburo, the Fed cashiered the two most indefensible scapegoats to divert attention from the equally corrupt incumbents presiding over the collapse of Fed credibility.

Don't be surprised if the scapegoats are airbrushed out of official photos, per officially approved propaganda.

3. As I detailed in The U.S. Economy In a Nutshell: When Critical Parts Are On "Indefinite Back Order," the Machine Grinds to a Halt and Sorry, Fed, Inflation is Already Embedded, the fuel of the inflation rocket has just ignited and the clueless, corrupt Fed is watching the boost phase in abject, humiliating confusion, as the Fed is now completely powerless, having blown the opportunity to get ahead of the curve by reducing their making billionaires richer "stimulus" a year ago.

Inflation is not just embedded, it's global.

Natural gas prices could triple in entire regions without even breathing hard, and the costs of other essentials could just as easily triple without breaking a sweat.

Inflation crushes risk-on speculative markets like, well, scurrying cockroaches.

Squish.

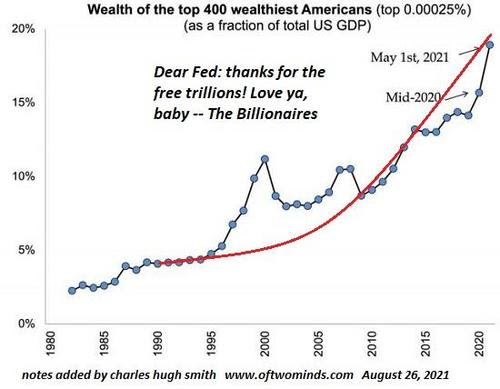

4. The Fed has lost control of yields. We all know that liars reveal their dishonesty via micro-signals, and with this in mind, slow down the video of Fed Politburo speakers, starting with Chairperson Powell. Wealth inequality soaring? It's not our doing! etc.

Oops, the cat is out of the bag: the Fed has lost control of yields. Trust in the Fed's god-like powers is wavering, as punters and players realize the Fed's shuck-and-jive has finally lost its power to wow the greedy and the credulous.

Rising yields crush risk-on speculative markets like, well, scurrying cockroaches.

Squish.

5. China is not "saving the world" this time.

As I explained in What's Really Going On in China (September 23, 2021), China has other fish to fry and it isn't bailing out global markets as it did in previous bubble pops. Squish.

6. The rising US dollar is Kryptonite to speculative markets, emerging market debt and risk-on euphoria.

Sorry about that, but you know what happens next: Squish.

7. The retail bagholders are now all-in. As I noted in Please Don't Pop Our Precious Bubble! (September 8, 2021), the retail punters have finally gone all-in on the "this bubble will never pop" Everything Bubble. As I observed in August, The Smart Money Has Already Sold (August 18, 2021) as the retail bagholders have poured more cash into the Everything Bubble than they did in the past decade or two.

This is of course the most reliable signal that a bubble is about to pop.

Sorry about that: squish.

8. The buy the dip crowd has been so well-trained that they will provide the necessary buying to keep the cascade from gathering too much momentum. A stairstep down that sucks in buy the dip buyers is ideal for those profiting from the decline. First up: a rally to close the quarter positively to make it appear that every money manager beat the index funds. And so on.

But the net result is still: squish.

Consequences can be put off for quite some time, but the rot beneath the machinations only amplifies the eventual collapse.

The banquet of consequences is being served, and risk-off crashes are, like revenge, best served cold.

Thursday, September 30, 2021

The Federal Reserve Hedge Fund

Dallas Fed President Kaplan Was Making Bold, Market-Moving Statements to Media

During 2020 Crisis; the Same Year He Traded Tens of Millions of Dollars in

Stocks and S&P 500 Futures

https://wallstreetonparade.com/2021/09/dallas-fed-president-kaplan-was-making-bold-market-moving-statements-to-media-during-2020-crisis-the-same-year-he-traded-tens-of-millions-of-dollars-in-stocks-and-sp-500-futures/

The Federal Reserve Hedge Fund

Was Boston Fed President Rosengren Trading with Citigroup’s Money?

https://wallstreetonparade.com/2021/09/was-boston-fed-president-rosengren-trading-with-citigroups-money/

Wednesday, September 22, 2021

Jamie Dimon’s Bank Has Been Moving Fast and Breaking Things – Like Money Laundering Laws. Now It’s Got Its Own Digital Coin and Bespoke Blockchain

Jamie Dimon’s Bank Has Been Moving Fast and Breaking Things – Like Money

Laundering Laws. Now It’s Got Its Own Digital Coin and Bespoke Blockchain

https://wallstreetonparade.com

By Pam Martens and Russ Martens: September 7, 2021 ~

Thursday, September 22, 2016

Wednesday, September 21, 2016

|